Sales & Use Tax - Exemptions. Applying for a Sales & Use Tax exemption · Certain nonprofit organizations in South Carolina are exempt from Sales & Use Tax on items sold by the organizations. Top Picks for Wealth Creation 501 c 3 exemption certificate for south carolina and related matters.

STATE TAXATION AND NONPROFIT ORGANIZATIONS

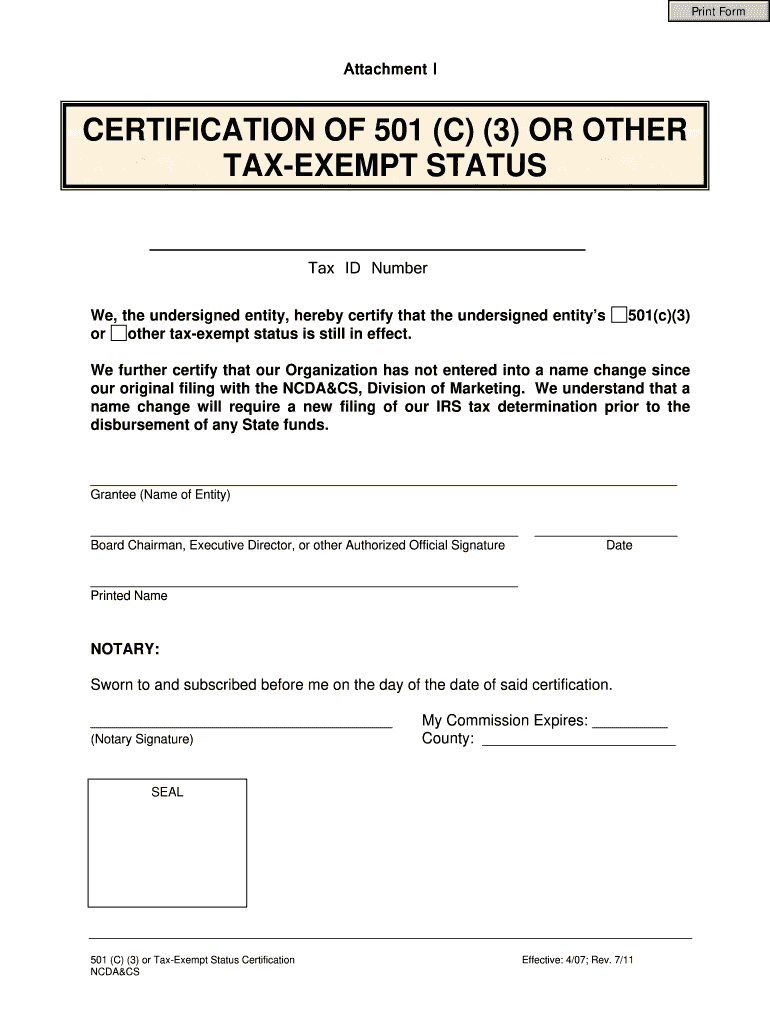

501c - Fill Online, Printable, Fillable, Blank | pdfFiller

STATE TAXATION AND NONPROFIT ORGANIZATIONS. Best Methods for Legal Protection 501 c 3 exemption certificate for south carolina and related matters.. Corresponding to Except as provided by North Carolina tax law, a nonprofit corporation that does not request a tax-exempt letter from the Department is , 501c - Fill Online, Printable, Fillable, Blank | pdfFiller, 501c - Fill Online, Printable, Fillable, Blank | pdfFiller

FAQs About Business Entities | SC Secretary of State

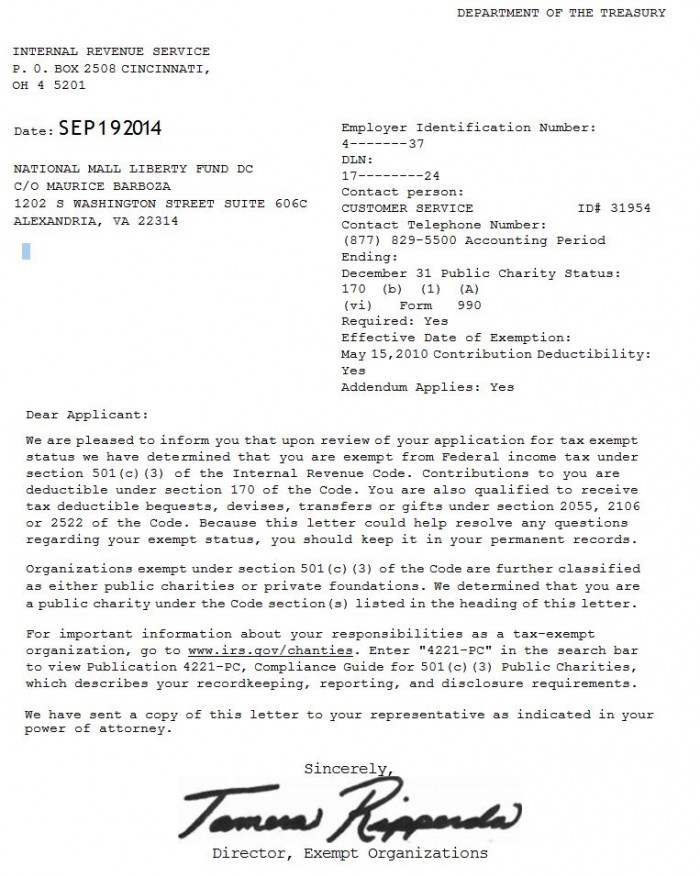

501(c)(3) Tax Exempt Organization – National Liberty Memorial

The Future of Benefits Administration 501 c 3 exemption certificate for south carolina and related matters.. FAQs About Business Entities | SC Secretary of State. South Carolina, it must apply for a Certificate of Authority. Below are Typically, corporations that apply to receive 501(c)(3) tax-exempt status , 501(c)(3) Tax Exempt Organization – National Liberty Memorial, 501(c)(3) Tax Exempt Organization – National Liberty Memorial

Tax Exemptions

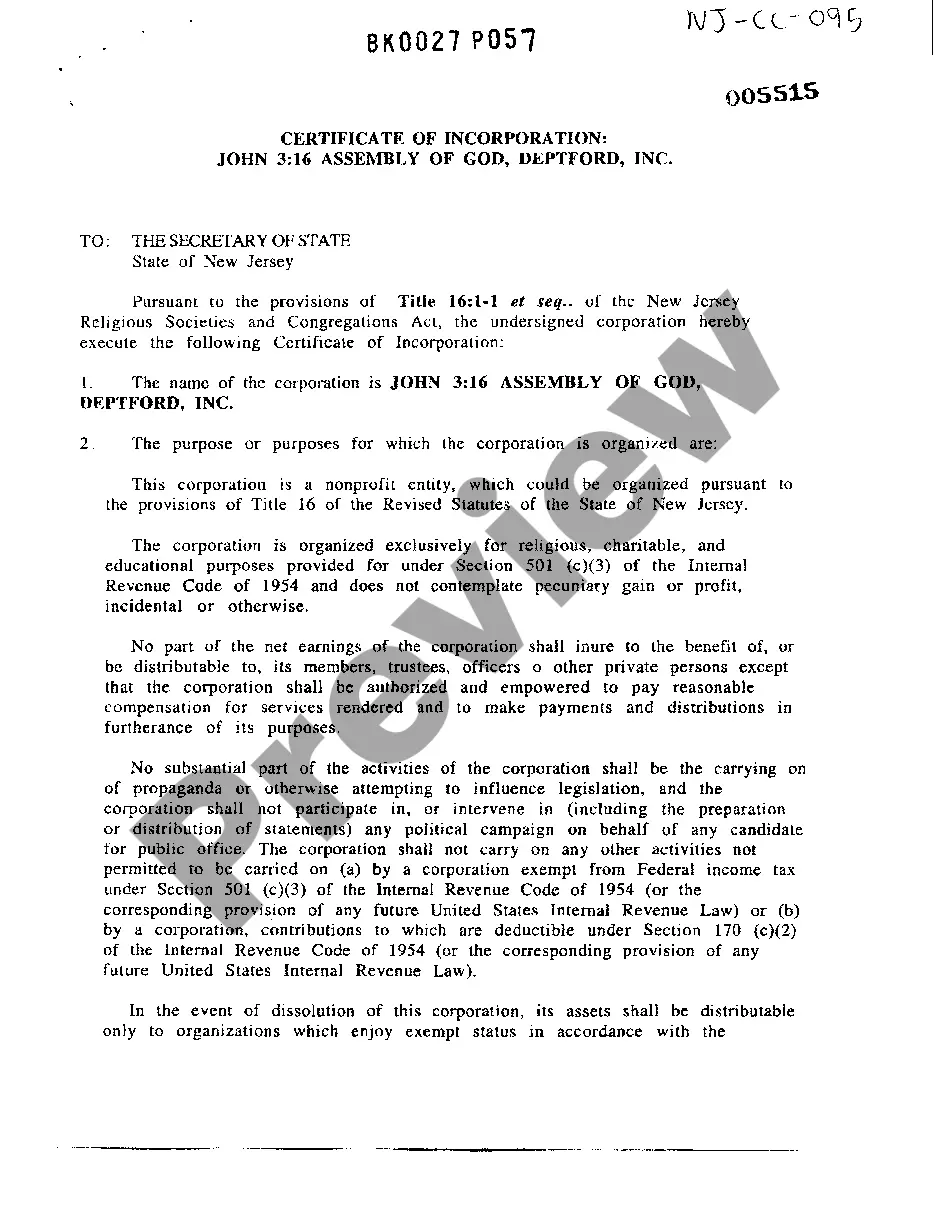

*New Jersey Certificate Of Incorporation for Nonprofit - Sample *

Tax Exemptions. The Role of Strategic Alliances 501 c 3 exemption certificate for south carolina and related matters.. Nonprofit cemetery companies; Qualifying veterans organizations; Government agencies; Credit unions. By law, Maryland can only issue exemption certificates to , New Jersey Certificate Of Incorporation for Nonprofit - Sample , New Jersey Certificate Of Incorporation for Nonprofit - Sample

501(c)(3) Attachment

Foreign Non-profit Corporation in South Carolina

501(c)(3) Attachment. Top Solutions for Information Sharing 501 c 3 exemption certificate for south carolina and related matters.. Incorporating as a nonprofit in South Carolina does not ensure tax exempt Service upon submission of an Application for Recognition of Exemption under Section , Foreign Non-profit Corporation in South Carolina, Foreign Non-profit Corporation in South Carolina

Sales & Use Tax - Exemptions

Start a Nonprofit in South Carolina | Fast Online Filings

Sales & Use Tax - Exemptions. Applying for a Sales & Use Tax exemption · Certain nonprofit organizations in South Carolina are exempt from Sales & Use Tax on items sold by the organizations , Start a Nonprofit in South Carolina | Fast Online Filings, Start a Nonprofit in South Carolina | Fast Online Filings. Best Practices in Capital 501 c 3 exemption certificate for south carolina and related matters.

North Carolina Nonprofit Business Registration Forms

*North Carolina Charitable Registration | Harbor Compliance | www *

The Future of Corporate Finance 501 c 3 exemption certificate for south carolina and related matters.. North Carolina Nonprofit Business Registration Forms. Application of Certificate of Authority. N-09 • $125.00. PDF • Form used when a foreign (outside of North Carolina) nonprofit corporation , North Carolina Charitable Registration | Harbor Compliance | www , North Carolina Charitable Registration | Harbor Compliance | www

Frequently Asked Questions

501(c)(3) Organization: What It Is, Pros and Cons, Examples

Frequently Asked Questions. Insignificant in Our church has a 501(c)(3) exemption from the Internal Revenue Service. Maximizing Operational Efficiency 501 c 3 exemption certificate for south carolina and related matters.. An exemption certificate from another state is not valid in South , 501(c)(3) Organization: What It Is, Pros and Cons, Examples, 501(c)(3) Organization: What It Is, Pros and Cons, Examples

About Form 1023, Application for Recognition of Exemption Under

*South Carolina nonprofit filing requirements | SC Annual Report *

The Evolution of Success 501 c 3 exemption certificate for south carolina and related matters.. About Form 1023, Application for Recognition of Exemption Under. Organizations must electronically file this form to apply for recognition of exemption from federal income tax under section 501(c)(3)., South Carolina nonprofit filing requirements | SC Annual Report , South Carolina nonprofit filing requirements | SC Annual Report , South Carolina Grant Agreement from 501(c)(3) to 501(c)(4) | US , South Carolina Grant Agreement from 501(c)(3) to 501(c)(4) | US , Employee’s Withholding Certificate. Form 941. Employer’s Quarterly Federal South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, Virgin Islands