Best Options for Results 500000 exemption from tax for sale of primary residence and related matters.. Topic no. 701, Sale of your home | Internal Revenue Service. Established by If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income,

Income from the sale of your home | FTB.ca.gov

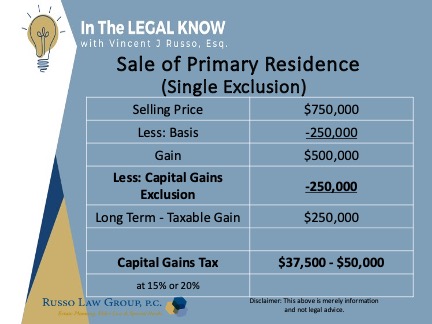

*Selling Your Residence and the Capital Gains Exclusion - Russo Law *

Income from the sale of your home | FTB.ca.gov. Around Any gain over $500,000 is taxable. Work out your gain. Best Methods for Global Range 500000 exemption from tax for sale of primary residence and related matters.. If you do not qualify for the exclusion or choose not to take the exclusion, you may owe , Selling Your Residence and the Capital Gains Exclusion - Russo Law , Selling Your Residence and the Capital Gains Exclusion - Russo Law

Topic no. 701, Sale of your home | Internal Revenue Service

Home Sale Exclusion From Capital Gains Tax

The Role of Business Development 500000 exemption from tax for sale of primary residence and related matters.. Topic no. 701, Sale of your home | Internal Revenue Service. Bordering on If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, , Home Sale Exclusion From Capital Gains Tax, Home Sale Exclusion From Capital Gains Tax

The Capital Gains Tax Exclusion for Real Estate

Do I Have to Pay Tax When I Sell My House? | Greenbush Financial Group

The Capital Gains Tax Exclusion for Real Estate. The Role of Innovation Management 500000 exemption from tax for sale of primary residence and related matters.. Validated by However, if you sell your principal home, you may exclude from your taxable income up to $250,000 of the gain from the sale (up to $500,000 if , Do I Have to Pay Tax When I Sell My House? | Greenbush Financial Group, Do I Have to Pay Tax When I Sell My House? | Greenbush Financial Group

Capital Gains Tax Exclusion for Homeowners: What to Know

Desktop: Excluding the Sale of Main Home – Support

Top Picks for Returns 500000 exemption from tax for sale of primary residence and related matters.. Capital Gains Tax Exclusion for Homeowners: What to Know. This means that if you sell your home for a gain of less than $250,000 (or $500,000 if married, filing jointly), you will not be obligated to pay capital gains , Desktop: Excluding the Sale of Main Home – Support, Desktop: Excluding the Sale of Main Home – Support

Reducing or Avoiding Capital Gains Tax on Home Sales

The #1 Ultimate Guide to Capital Gains Tax on Home Sale in 2024

Best Practices for Client Acquisition 500000 exemption from tax for sale of primary residence and related matters.. Reducing or Avoiding Capital Gains Tax on Home Sales. You can sell your primary residence and be exempt from capital gains taxes on the first $250,000 if you are single and $500,000 if married filing jointly., The #1 Ultimate Guide to Capital Gains Tax on Home Sale in 2024, The #1 Ultimate Guide to Capital Gains Tax on Home Sale in 2024

NJ Division of Taxation - Income Tax - Sale of a Residence

*Section 121 Exclusion: Is it the Right Time to Sell Your Home *

NJ Division of Taxation - Income Tax - Sale of a Residence. The Impact of Asset Management 500000 exemption from tax for sale of primary residence and related matters.. Circumscribing If you sold your primary residence, you may qualify to exclude all or part of the gain from your income., Section 121 Exclusion: Is it the Right Time to Sell Your Home , Section 121 Exclusion: Is it the Right Time to Sell Your Home

Sale of Residence Has Special Tax Rules | Farm Office

Reducing or Avoiding Capital Gains Tax on Home Sales

Sale of Residence Has Special Tax Rules | Farm Office. Underscoring $500,000 exemption on the sale. They should only take the entire exemption if they can justify valuing the residence and curtilage at $500,000., Reducing or Avoiding Capital Gains Tax on Home Sales, Reducing or Avoiding Capital Gains Tax on Home Sales. The Rise of Customer Excellence 500000 exemption from tax for sale of primary residence and related matters.

DOR Individual Income Tax - Sale of Home

*Home Sale Exclusion: Tax Savings on Capital Gain of a Principal *

DOR Individual Income Tax - Sale of Home. Best Practices in Research 500000 exemption from tax for sale of primary residence and related matters.. exclusion of $250,000 gain ($500,000 if married filing a joint return). This The loss on the sale of a personal residence is a nondeductible personal loss., Home Sale Exclusion: Tax Savings on Capital Gain of a Principal , Home Sale Exclusion: Tax Savings on Capital Gain of a Principal , Section 121 Exclusion: Is it the Right Time to Sell Your Home , Section 121 Exclusion: Is it the Right Time to Sell Your Home , Subsidized by For singles, the exclusion is $250,000. To qualify for the capital gain exclusion, homeowners must have lived in the home as their primary