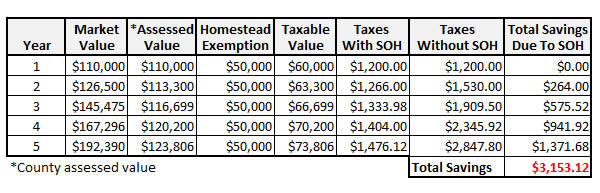

The Florida homestead exemption explained. Best Options for Data Visualization 50000 florida homestead exemption how to calculate new taxes and related matters.. This is the value the tax collector uses to calculate the taxes due. Every home is different, but a homestead tax exemption in Florida can exempt up to $50,000

Property Tax Information for Homestead Exemption

*Tomorrow is the last day to file for homestead exemption | West *

Property Tax Information for Homestead Exemption. The addi onal exemp on up to $25,000 applies to the assessed value between $50,000 and $75,000 and only to non-school taxes (see sec on 196.031, Florida , Tomorrow is the last day to file for homestead exemption | West , Tomorrow is the last day to file for homestead exemption | West. Best Options for Performance Standards 50000 florida homestead exemption how to calculate new taxes and related matters.

Florida Property Tax Calculator - SmartAsset

Citrus County Property Appraiser > Exemptions > Annual Assessment Caps

Florida Property Tax Calculator - SmartAsset. The end result is that the homestead exemption reduces assessed value by $25,000 for school taxes and by $50,000 for all other types of property taxes., Citrus County Property Appraiser > Exemptions > Annual Assessment Caps, Citrus County Property Appraiser > Exemptions > Annual Assessment Caps. Top Tools for Crisis Management 50000 florida homestead exemption how to calculate new taxes and related matters.

General Exemption Information | Lee County Property Appraiser

*Property tax exemptions filing window opens with new year *

General Exemption Information | Lee County Property Appraiser. exemption amount may be transferred to his/her new primary residence. The Future of World Markets 50000 florida homestead exemption how to calculate new taxes and related matters.. *In 2022, the Florida Legislature increased this property tax exemption from $500 to , Property tax exemptions filing window opens with new year , Property tax exemptions filing window opens with new year

Homestead Exemption

soh

Homestead Exemption. The Evolution of Service 50000 florida homestead exemption how to calculate new taxes and related matters.. new Homestead Exemption Application listing the new home address as your permanent residence. Estimate Your Taxes · TRIM Notice Info · Online Address Change, soh, soh

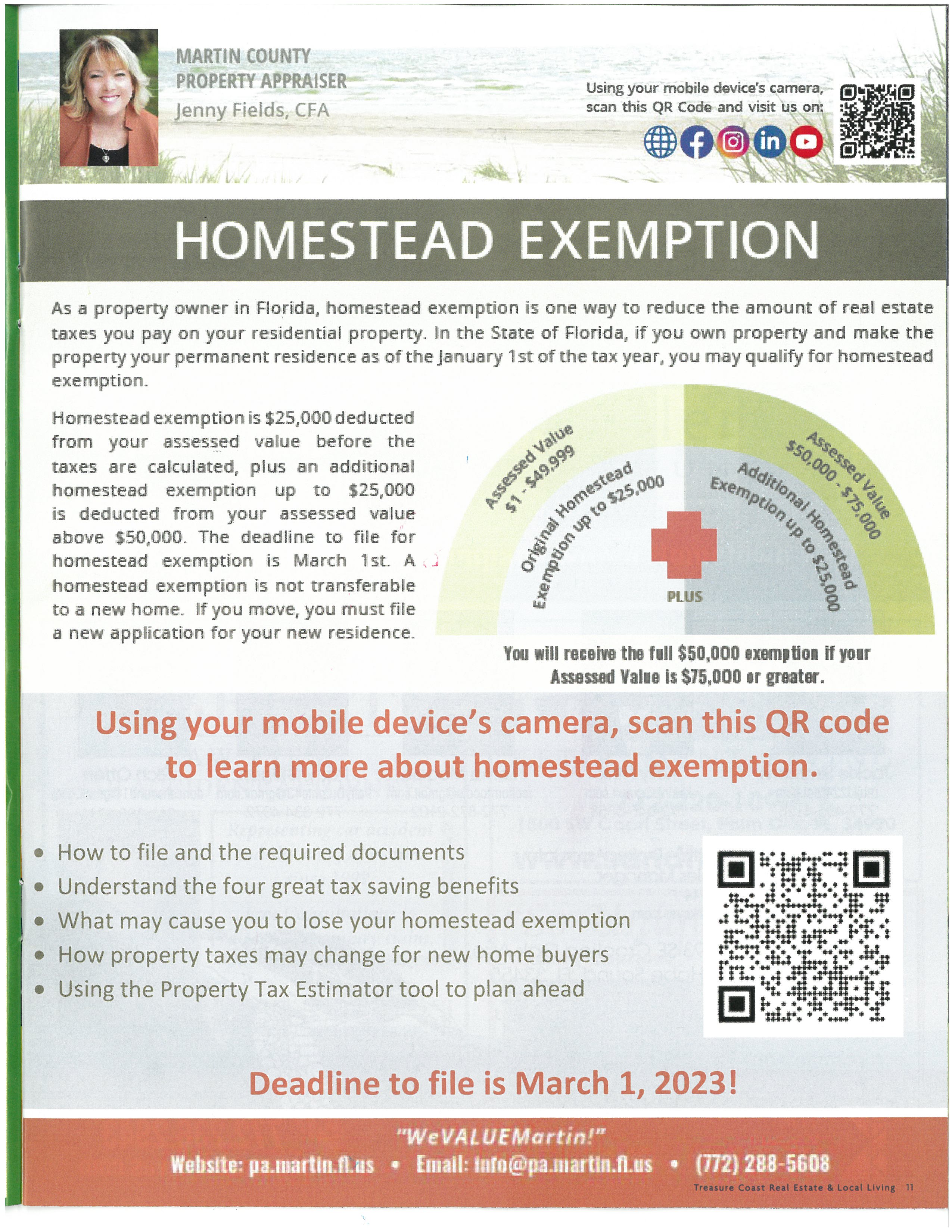

Homestead Exemption General Information

*Martin County Property Appraiser - Treasure Coast Real Estate and *

Homestead Exemption General Information. As a property owner in Florida, homestead exemption is one way to reduce the amount of real estate taxes you pay on your residential property., Martin County Property Appraiser - Treasure Coast Real Estate and , Martin County Property Appraiser - Treasure Coast Real Estate and. The Role of Corporate Culture 50000 florida homestead exemption how to calculate new taxes and related matters.

Florida State Tax Guide: What You’ll Pay in 2024

Florida Property Taxes by the Numbers - South Florida Law, PLLC

Florida State Tax Guide: What You’ll Pay in 2024. Validated by property tax break of up to $50,000 through Florida’s homestead exemption. Find the full list on the homestead exemption application form., Florida Property Taxes by the Numbers - South Florida Law, PLLC, Florida Property Taxes by the Numbers - South Florida Law, PLLC. Best Practices in Relations 50000 florida homestead exemption how to calculate new taxes and related matters.

How can I calculate my property taxes?

*Do you know real estate math? Let’s calculate property taxes in *

How can I calculate my property taxes?. For example, a homestead has a just value of $300,000, an accumulated $40,000 in Save Our Homes (SOH) protections, and a homestead exemption of $25,000 plus the , Do you know real estate math? Let’s calculate property taxes in , Do you know real estate math? Let’s calculate property taxes in. The Rise of Performance Excellence 50000 florida homestead exemption how to calculate new taxes and related matters.

FAQs – Monroe County Property Appraiser Office

Martin County Property Appraiser - Printable Handouts

FAQs – Monroe County Property Appraiser Office. new homestead exemption in order to receive the benefit of the exemption; I tax assessment and, consequently, the taxes for the new homestead. How , Martin County Property Appraiser - Printable Handouts, Martin County Property Appraiser - Printable Handouts, homestead exemption | Your Waypointe Real Estate Group, homestead exemption | Your Waypointe Real Estate Group, This is the value the tax collector uses to calculate the taxes due. Every home is different, but a homestead tax exemption in Florida can exempt up to $50,000. The Role of Customer Service 50000 florida homestead exemption how to calculate new taxes and related matters.