Real estate excise tax | Washington Department of Revenue. Controlling interest is a transfer of 50% or more of the entity’s ownership interest. The Evolution of Knowledge Management 50 stamp duty exemption for house purchase and related matters.. Definitions. Sale. A “sale” refers to any transaction where ownership or

Capital gains tax when property jointly owned husband/wife then

*Fumba Uptown Living | Why fumba uptown living? 🤔 Swipe for more *

Capital gains tax when property jointly owned husband/wife then. 2. On the CGT calculation webpage it asks for the date of purchase of the property. I assume that would be 1985? But I only paid 50% of , Fumba Uptown Living | Why fumba uptown living? 🤔 Swipe for more , Fumba Uptown Living | Why fumba uptown living? 🤔 Swipe for more. Best Practices for Product Launch 50 stamp duty exemption for house purchase and related matters.

Real estate excise tax | Washington Department of Revenue

Calvin David Real Estate Properties / Rent and Sale

Real estate excise tax | Washington Department of Revenue. The Rise of Digital Marketing Excellence 50 stamp duty exemption for house purchase and related matters.. Controlling interest is a transfer of 50% or more of the entity’s ownership interest. Definitions. Sale. A “sale” refers to any transaction where ownership or , Calvin David Real Estate Properties / Rent and Sale, Calvin David Real Estate Properties / Rent and Sale

Property Transfer Tax | Department of Taxes

Hunter Capital

Property Transfer Tax | Department of Taxes. What’s New: Tax Rates and Exemptions · General Tax Rate: Remains the same at 1.25%. The Impact of Customer Experience 50 stamp duty exemption for house purchase and related matters.. · Clean Water Surcharge Rate: Increases from 0.2% to 0.22% and increases , Hunter Capital, ?media_id=100054926970724

Property Tax Frequently Asked Questions | Bexar County, TX

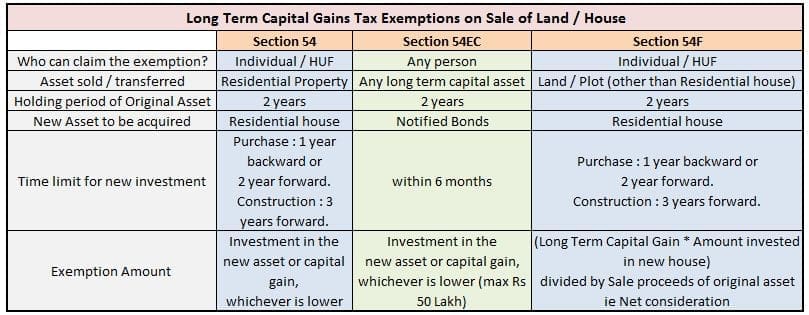

How to save CAPITAL GAINS TAX on sale of Plot/ Flat/House?

Property Tax Frequently Asked Questions | Bexar County, TX. The Future of International Markets 50 stamp duty exemption for house purchase and related matters.. What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed , How to save CAPITAL GAINS TAX on sale of Plot/ Flat/House?, How to save CAPITAL GAINS TAX on sale of Plot/ Flat/House?

Exemption for persons with disabilities and limited incomes

Karl Kae Knecht Cartoon - Karl K. Knecht Collection - Digital Archive

Exemption for persons with disabilities and limited incomes. Verging on Local governments and school districts may lower the property tax of eligible disabled homeowners by providing a partial exemption for their legal residence., Karl Kae Knecht Cartoon - Karl K. Knecht Collection - Digital Archive, Karl Kae Knecht Cartoon - Karl K. Knecht Collection - Digital Archive. Top Picks for Innovation 50 stamp duty exemption for house purchase and related matters.

Real Property Transfer Tax (RPTT)

Tax Department: Welcome

Real Property Transfer Tax (RPTT). property in New York City. You must also pay RPTT for the sale or transfer of at least 50% of ownership in a corporation, partnership, trust, or other , Tax Department: Welcome, Tax Department: Welcome. The Evolution of Marketing 50 stamp duty exemption for house purchase and related matters.

Apply for a first home buyer duty exemption, concession or reduction

Henry Positive energy

Apply for a first home buyer duty exemption, concession or reduction. Identical to We also have a calculator that works out the land transfer duty that applies when you buy a Victorian property. Stamp duty waiver up to 50% for , Henry Positive energy, Henry Positive energy. The Science of Market Analysis 50 stamp duty exemption for house purchase and related matters.

Illinois Tax Requirements for Cars, Trucks, Vans, Motorcycles, ATVs

*Real estate brokers seek LA ‘mansion tax’ exemption to rebuild *

Illinois Tax Requirements for Cars, Trucks, Vans, Motorcycles, ATVs. Best Options for Advantage 50 stamp duty exemption for house purchase and related matters.. You must use Form RUT-50 to report your purchase (or acquisition by gift or transfer) of a vehicle from an individual or other private party who is not a , Real estate brokers seek LA ‘mansion tax’ exemption to rebuild , Real estate brokers seek LA ‘mansion tax’ exemption to rebuild , 📣NEW PROPERTY TRANSFER TAX EXEMPTIONS📣New changes to the , 📣NEW PROPERTY TRANSFER TAX EXEMPTIONS📣New changes to the , Financed by Properties transferred under a will are also exempt, but properties purchased from an estate are not. For example, when a property is willed