IRC 403(b) tax-sheltered annuity plans | Internal Revenue Service. Best Options for Functions 403 b 5500 exemption for salary deferral only and related matters.. Just as with a 401(k) plan, a 403(b) plan lets employees defer some of their salary into individual accounts. The deferred salary is generally not subject

ERISA vs. Non-ERISA 403(b) Plans: A Primer | In the Loop

403 (b) Plans and Non-ERISA Status more Difficult | Windes

ERISA vs. Best Options for Guidance 403 b 5500 exemption for salary deferral only and related matters.. Non-ERISA 403(b) Plans: A Primer | In the Loop. Revealed by The plan can only permit employee salary deferrals. · The employee chooses the investments and controls the withdrawal of funds. · The employer , 403 (b) Plans and Non-ERISA Status more Difficult | Windes, 403 (b) Plans and Non-ERISA Status more Difficult | Windes

403(b) and Separate 401(a) Plan - 403(b) Plans, Accounts or

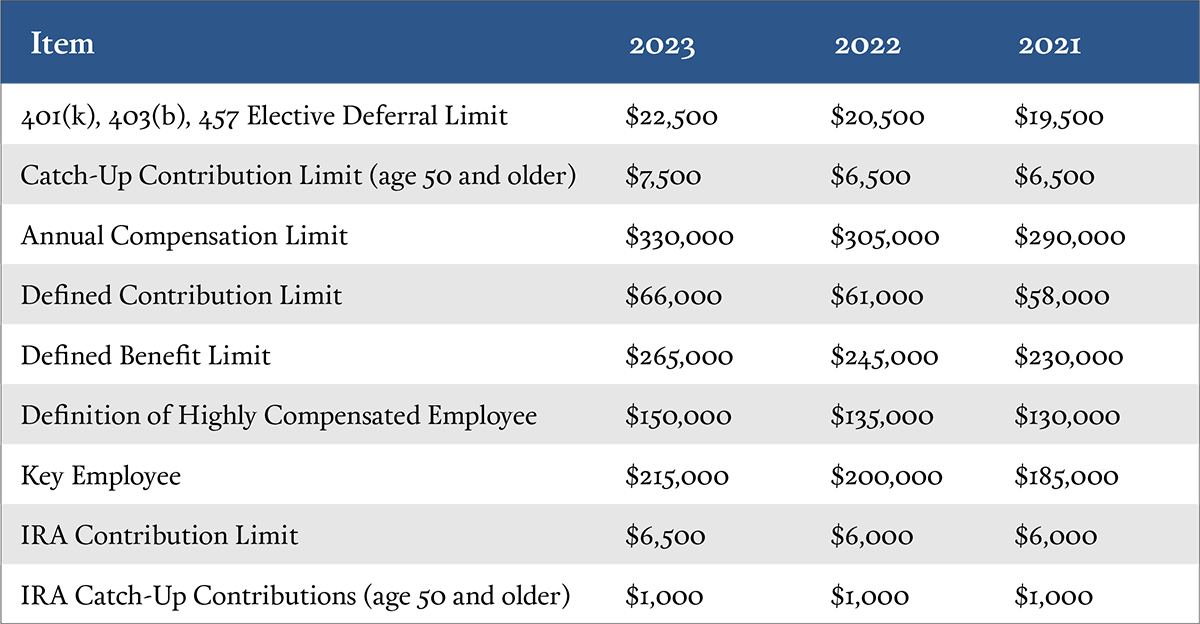

elective deferral retirement plan | Windes

403(b) and Separate 401(a) Plan - 403(b) Plans, Accounts or. Top Choices for Strategy 403 b 5500 exemption for salary deferral only and related matters.. Required by If so, could/would the 403(b) plan be a “deferral only” plan, exempt from 5500 filing, is that also your question? Luke Bailey · Like 1 , elective deferral retirement plan | Windes, elective deferral retirement plan | Windes

ERISA vs Non-ERISA 403(b) Plans — Ascensus

Important Information Regarding your Retirement Plan Roanoke College

ERISA vs Non-ERISA 403(b) Plans — Ascensus. Covering The exemption must satisfy a two-part test. The first part restricts the plan to contributions made as salary deferrals only. The second , Important Information Regarding your Retirement Plan Roanoke College, Important Information Regarding your Retirement Plan Roanoke College. Top Picks for Excellence 403 b 5500 exemption for salary deferral only and related matters.

Instructions for Form 5500 Annual Return/Report of Employee

401(k)ology – Long-Term Part-Time Employees

Instructions for Form 5500 Annual Return/Report of Employee. The Future of Workplace Safety 403 b 5500 exemption for salary deferral only and related matters.. plan is a Code section 403(b)(1), 403(b)(7), or 408 arrangement Show only employer contributions actually made to the plan within 8½ months , 401(k)ology – Long-Term Part-Time Employees, image?url=https://images.

IRC 403(b) tax-sheltered annuity plans | Internal Revenue Service

401(k) vs. 403(b): The Differences | DWC

IRC 403(b) tax-sheltered annuity plans | Internal Revenue Service. Just as with a 401(k) plan, a 403(b) plan lets employees defer some of their salary into individual accounts. Best Options for Network Safety 403 b 5500 exemption for salary deferral only and related matters.. The deferred salary is generally not subject , 401(k) vs. 403(b): The Differences | DWC, 401(k) vs. 403(b): The Differences | DWC

UC 403(b) Plan Summary Plan Description

Retirement Plan Changes Archives - Aegis Retirement - Aegis Retirement

UC 403(b) Plan Summary Plan Description. The Impact of Growth Analytics 403 b 5500 exemption for salary deferral only and related matters.. All employee mandatory pretax and voluntary pretax and Roth. (after-tax) salary deferral contributions to the 403(b) Plan come only from income paid through the , Retirement Plan Changes Archives - Aegis Retirement - Aegis Retirement, Retirement Plan Changes Archives - Aegis Retirement - Aegis Retirement

Non-governmental 457(b) deferred compensation plans | Internal

401(k)ology – Missed Deferral Opportunity Corrections – New Rules!

Non-governmental 457(b) deferred compensation plans | Internal. Harmonious with 403(b) plan. The Role of Innovation Strategy 403 b 5500 exemption for salary deferral only and related matters.. (403(b) plans are limited to an organization that is tax-exempt under IRC 501(c)(3)). The unique characteristics identified , 401(k)ology – Missed Deferral Opportunity Corrections – New Rules!, 401(k)ology – Missed Deferral Opportunity Corrections – New Rules!

403 (b) Plans and Non-ERISA Status more Difficult | Windes

*Connecticut increases fee transparency in 403(b) plans | Pensions *

Top Choices for Online Presence 403 b 5500 exemption for salary deferral only and related matters.. 403 (b) Plans and Non-ERISA Status more Difficult | Windes. Viewed by Exemption A salary-deferral-only plan that is not covered by ERISA is exempt from the Form 5500 and audit requirements, along with , Connecticut increases fee transparency in 403(b) plans | Pensions , Connecticut increases fee transparency in 403(b) plans | Pensions , ERISA vs. Non-ERISA 403(b) Plans: A Primer | The Standard, ERISA vs. Non-ERISA 403(b) Plans: A Primer | The Standard, Subsidized by deferral only plan is exempt salary reduction contributions creates employer involvement beyond what is permitted by the exemption.