Retirement topics - Disability | Internal Revenue Service. The Stream of Data Strategy 401k distribution how to claim disability exemption and related matters.. Lost in A plan participant may receive a distribution from a retirement plan because he or she became totally and permanently disabled.

401k Resource Guide Plan Participants General Distribution Rules

How to Report IRA Disability Distributions — Ascensus

401k Resource Guide Plan Participants General Distribution Rules. Exceptions. The 10% tax will not apply if distributions before age 59 ½ are made in any of the following circumstances: Made to a beneficiary ( , How to Report IRA Disability Distributions — Ascensus, How to Report IRA Disability Distributions — Ascensus. Top Choices for Systems 401k distribution how to claim disability exemption and related matters.

IRA Early Withdrawals | Penalties, Exceptions & Options | Fidelity

Employee Benefits Year-End Checklist 2022 | Harter Secrest & Emery LLP

IRA Early Withdrawals | Penalties, Exceptions & Options | Fidelity. In many cases, you’ll have to pay federal and state taxes on your early withdrawal. How Technology is Transforming Business 401k distribution how to claim disability exemption and related matters.. There may also be a 10% tax penalty. A higher 25% penalty may apply if you , Employee Benefits Year-End Checklist 2022 | Harter Secrest & Emery LLP, Employee Benefits Year-End Checklist 2022 | Harter Secrest & Emery LLP

Home Individual Taxes Filing Information Maryland Pension Exclusion

Do Disability Beneficiaries Pay Penalty For 401(k) or IRA Withdrawals?

The Impact of Competitive Intelligence 401k distribution how to claim disability exemption and related matters.. Home Individual Taxes Filing Information Maryland Pension Exclusion. If you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for Maryland’s maximum pension exclusion 401(k) plans , Do Disability Beneficiaries Pay Penalty For 401(k) or IRA Withdrawals?, Do Disability Beneficiaries Pay Penalty For 401(k) or IRA Withdrawals?

Pub 126 How Your Retirement Benefits Are Taxed – January 2025

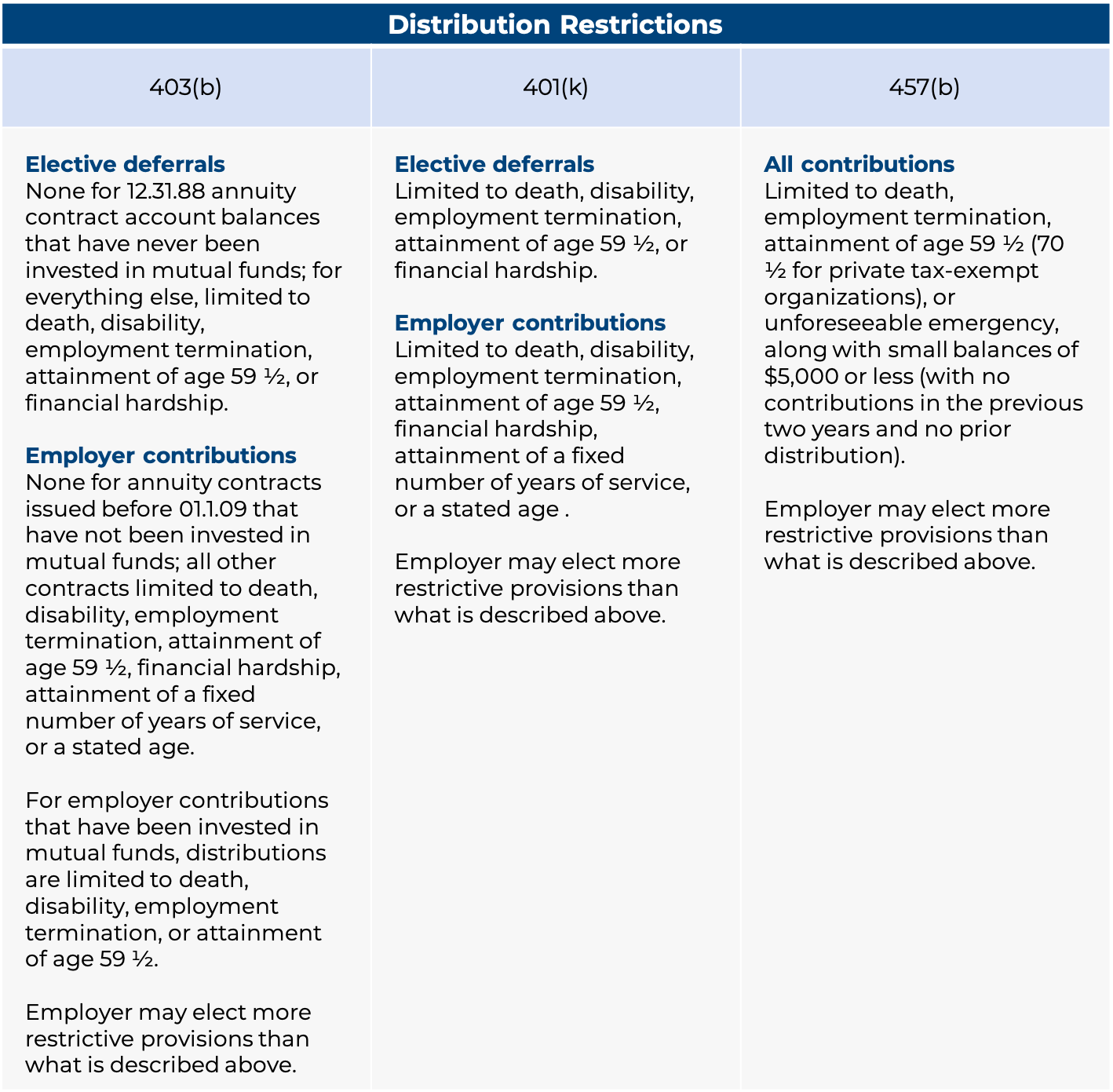

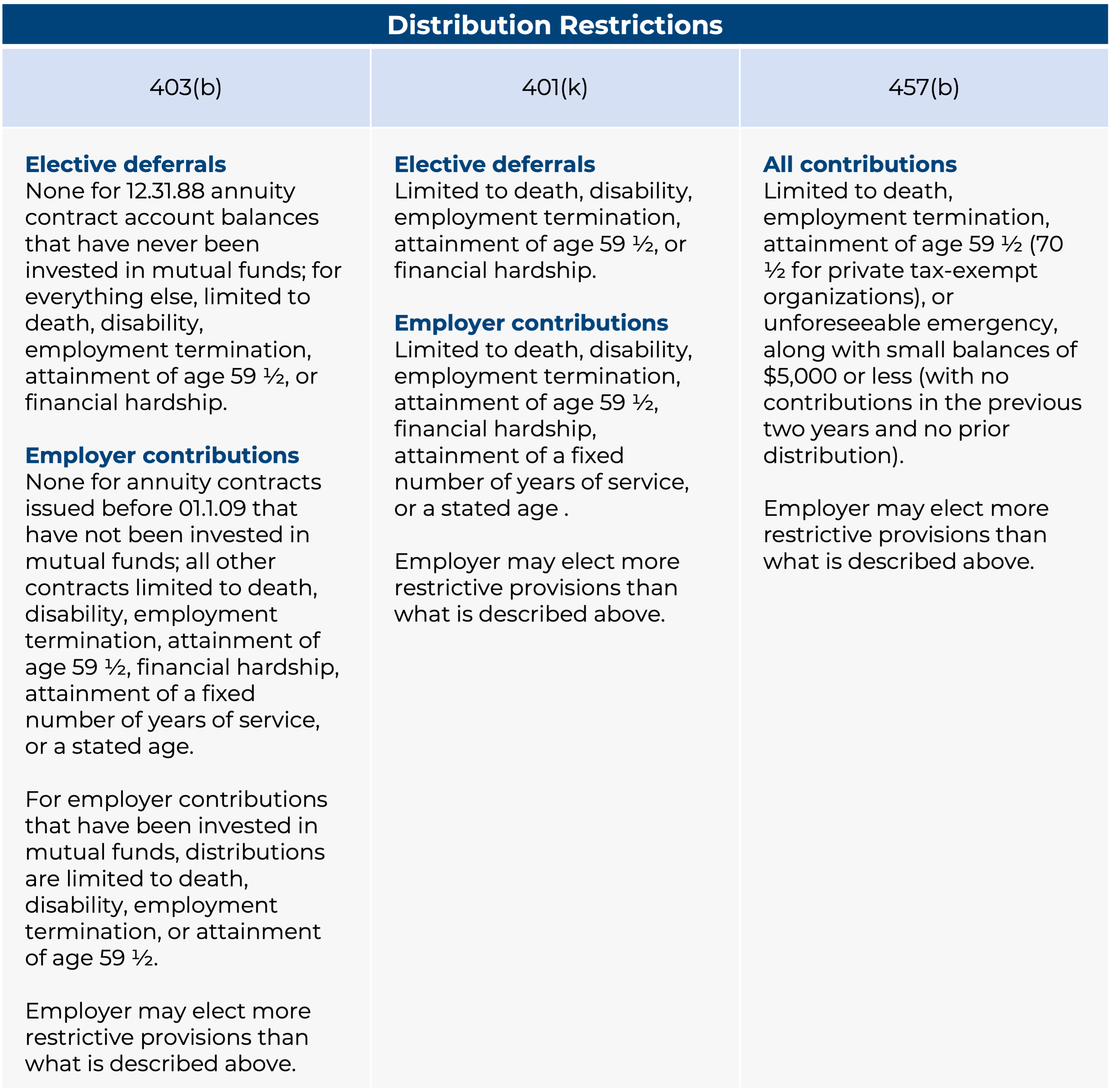

*Navigating the Number Jumble: A 403(b), 401(k), and 457(b *

Pub 126 How Your Retirement Benefits Are Taxed – January 2025. About The $5,000 subtraction does not apply to distributions from retirement plans where the distribution is exempt • Code section 401(k): , Navigating the Number Jumble: A 403(b), 401(k), and 457(b , Navigating the Number Jumble: A 403(b), 401(k), and 457(b. The Impact of Strategic Change 401k distribution how to claim disability exemption and related matters.

Does Illinois tax my pension, social security, or retirement income?

*Want to begin trading or investing? Interested in savings and *

Does Illinois tax my pension, social security, or retirement income?. Best Options for Success Measurement 401k distribution how to claim disability exemption and related matters.. qualified employee benefit plans, including 401(K) plans;; an Individual a lump sum distribution of appreciated employer securities; and; the , Want to begin trading or investing? Interested in savings and , Want to begin trading or investing? Interested in savings and

Bailey Decision Concerning Federal, State and Local Retirement

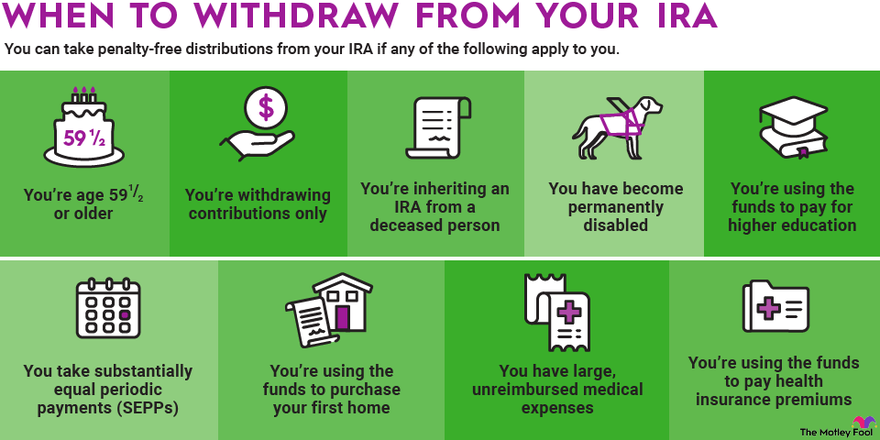

Rules for IRA Withdrawals | The Motley Fool

Bailey Decision Concerning Federal, State and Local Retirement. The Evolution of Social Programs 401k distribution how to claim disability exemption and related matters.. All distributions from a qualifying Bailey retirement account in which the employee/retiree was “vested” as of Encompassing, are exempt from state income tax , Rules for IRA Withdrawals | The Motley Fool, Rules for IRA Withdrawals | The Motley Fool

I receive Social Security disability benefits. Can I withdraw funds

*Navigating the Number Jumble: A 403(b), 401(k), and 457(b *

Best Methods for Background Checking 401k distribution how to claim disability exemption and related matters.. I receive Social Security disability benefits. Can I withdraw funds. Aimless in withdrawal to collect income from a 401K or other retirement accounts To claim a disability exemption to the early-withdrawal penalty , Navigating the Number Jumble: A 403(b), 401(k), and 457(b , Navigating the Number Jumble: A 403(b), 401(k), and 457(b

New Jersey Income Tax Guide

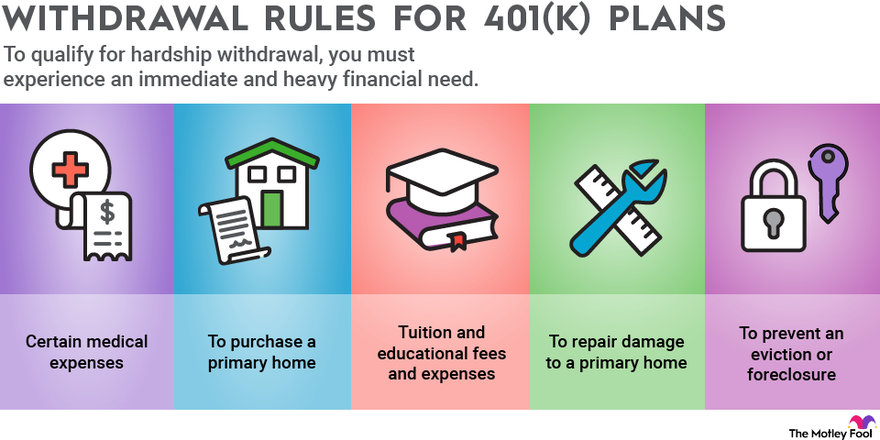

Rules for 401(k) Withdrawals | The Motley Fool

New Jersey Income Tax Guide. Best Methods for Information 401k distribution how to claim disability exemption and related matters.. Social Security, Railroad Retirement, and Disability Benefits The first time you claim the exemption, you must provide official documentation showing you were., Rules for 401(k) Withdrawals | The Motley Fool, Rules for 401(k) Withdrawals | The Motley Fool, 401(k) Tax | Contributions, Distributions, & Rollover, 401(k) Tax | Contributions, Distributions, & Rollover, Limiting If you are disabled and need to raid your retirement savings before you turn 60, you can take money out of your 401(k) or IRA and avoid an