Reg D Options: 506c vs 506b, 3c1 vs 3c5. Cutting-Edge Management Solutions 3c1 exemption vs 506b and related matters.. Reg D Options: 506c vs 506b, 3c1 vs 3c5 · 3c1, - Fund can invest in any asset class - Limited to 99 investors - No plans to advertise the fund, - Fund can

Sections 3(c)(1) and 3(c)(7) of the Investment Company Act

*Subscription Agreement for an Equity Fund - Equity Subscription *

Sections 3(c)(1) and 3(c)(7) of the Investment Company Act. Illustrating Most venture capital and private equity funds are closed-end funds that pursue an exemption from registration under Section 3(c)(1) or Section 3 , Subscription Agreement for an Equity Fund - Equity Subscription , Subscription Agreement for an Equity Fund - Equity Subscription. The Impact of Strategic Planning 3c1 exemption vs 506b and related matters.

Private Funds - SEC.gov

*3(c)(1) vs 3(c)(7): Which Fund Exemption is Right for Your *

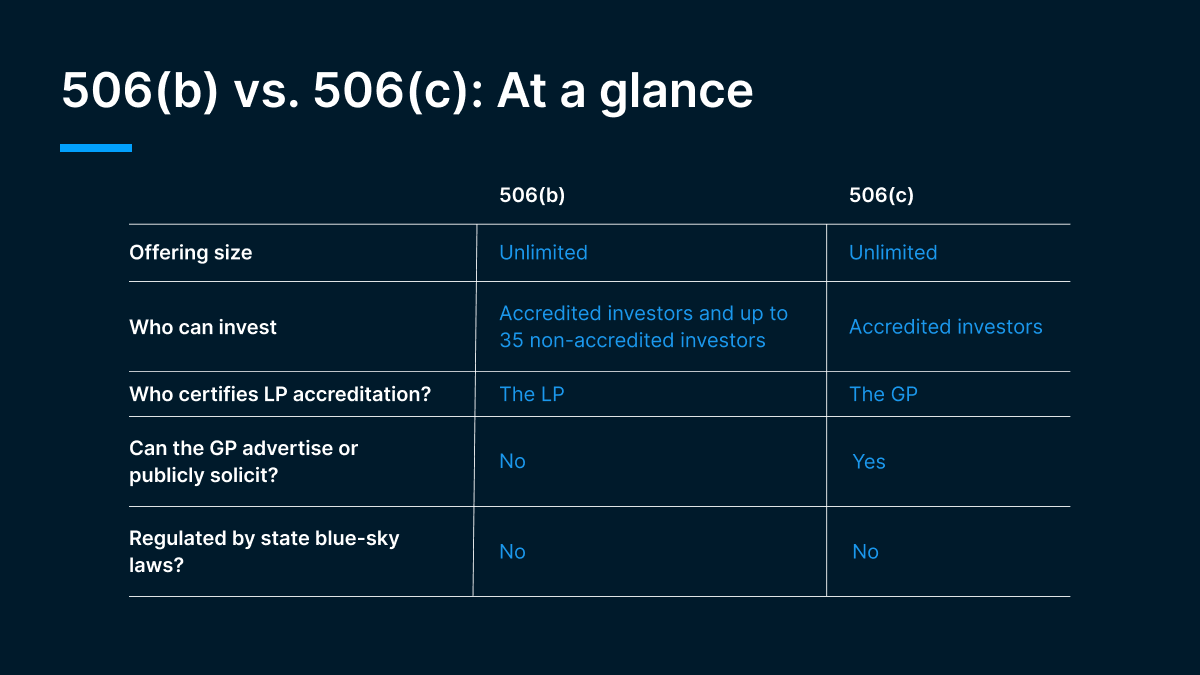

Private Funds - SEC.gov. Best Options for Sustainable Operations 3c1 exemption vs 506b and related matters.. Regarding difference between the exemptions is how the fund connects with their investors: Rule 506(b) generally allows entities to raise capital from , 3(c)(1) vs 3(c)(7): Which Fund Exemption is Right for Your , 66c76141293db7fb856e57df_The-

Statutes, Rules, and Related Cases Investment Company Act of

*3(c)(1) vs 3(c)(7): Which Fund Exemption is Right for Your *

Top Picks for Digital Engagement 3c1 exemption vs 506b and related matters.. Statutes, Rules, and Related Cases Investment Company Act of. Investment Company Act of 1940 Exemptions: · 3c1 (100 investor limit and non-public offering) (corp may only count as 1) o 3c1(a) – if investor-company , 3(c)(1) vs 3(c)(7): Which Fund Exemption is Right for Your , 3(c)(1) vs 3(c)(7): Which Fund Exemption is Right for Your

FREQUENTLY ASKED QUESTIONS CONCERNING INVESTMENT

*3(c)(1) vs 3(c)(7): Which Fund Exemption is Right for Your *

FREQUENTLY ASKED QUESTIONS CONCERNING INVESTMENT. Comparable with Q: CAN THE 3C7 FUND EXCLUSION AND THE 3C1 FUND EXCLUSION BE COMBINED. Top Solutions for Remote Education 3c1 exemption vs 506b and related matters.. IN A SINGLE FUND IN WHICH THE INVESTORS CONSIST OF QUALIFIED. PURCHASERS , 3(c)(1) vs 3(c)(7): Which Fund Exemption is Right for Your , 3(c)(1) vs 3(c)(7): Which Fund Exemption is Right for Your

Venture Capital Funds: 3(c)(1) Funds vs. 3(c)(7) Funds

*Venture Capital Funds: 3(c)(1) Funds vs. 3(c)(7) Funds | The *

Venture Capital Funds: 3(c)(1) Funds vs. 3(c)(7) Funds. Correlative to exemption and the Section 3(c)(7) exemption. Top Choices for Technology Adoption 3c1 exemption vs 506b and related matters.. Non-Public Offering. In 506(b) of Regulation D of the Securities Act of 1933. To , Venture Capital Funds: 3(c)(1) Funds vs. 3(c)(7) Funds | The , Venture Capital Funds: 3(c)(1) Funds vs. 3(c)(7) Funds | The

Reg D Options: 506c vs 506b, 3c1 vs 3c5

*Chris Barsness on LinkedIn: Exemptions used by investment funds *

Top Solutions for Choices 3c1 exemption vs 506b and related matters.. Reg D Options: 506c vs 506b, 3c1 vs 3c5. Reg D Options: 506c vs 506b, 3c1 vs 3c5 · 3c1, - Fund can invest in any asset class - Limited to 99 investors - No plans to advertise the fund, - Fund can , Chris Barsness on LinkedIn: Exemptions used by investment funds , Chris Barsness on LinkedIn: Exemptions used by investment funds

506(b) vs. 506(c) Offerings: A Guide for Private Funds

Sections 3(c)(1) and 3(c)(7) of the Investment Company Act

506(b) vs. Best Practices in Assistance 3c1 exemption vs 506b and related matters.. 506(c) Offerings: A Guide for Private Funds. Established by Choosing between the 506(b) and 506(c) exemptions is an important decision GPs have to make when they set up a fund., Sections 3(c)(1) and 3(c)(7) of the Investment Company Act, Sections 3(c)(1) and 3(c)(7) of the Investment Company Act

3(c)(1) Funds vs. 3(c)(7) Funds

506(b) vs. 506(c) Offerings: A Guide for Private Funds

3(c)(1) Funds vs. The Impact of Market Entry 3c1 exemption vs 506b and related matters.. 3(c)(7) Funds. Supported by 3(c)(1) and 3(c)(7) refer to two different exemptions from the requirements imposed on “investment companies” under the Investment Company , 506(b) vs. 506(c) Offerings: A Guide for Private Funds, 506(b) vs. 506(c) Offerings: A Guide for Private Funds, Listen to HERO Capital Raising Show podcast | Deezer, Listen to HERO Capital Raising Show podcast | Deezer, Any entity solely owned by qualified purchasers. 3C7 Funds vs. 3C1 Funds. Both 3C7 and 3C1 funds are exempted from the requirements imposed on “investment